Markerr’s “2Q21 REIT Roundup” examines the largest apartment owner-operators across the U.S., including UDR, MAA, Camden Property Trust, Equity Residential, Essex Property Trust, Apartment Income REIT and AvalonBay. We also explore a popular strategy targeting affluent renters, and use our Income and Employment data to identify the best expansion markets.

Market Trends: Revenue Growth Continues to Improve

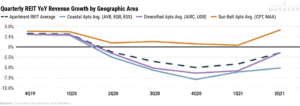

Markerr found that apartment revenue growth is up ~3% YoY, with Sun Belt markets consistently outperforming. The following chart illustrates the history of each REIT’s revenue growth.

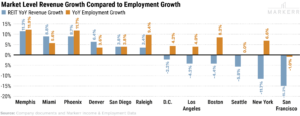

Secondary and tertiary markets performed the best, followed by other Sun Belt markets, as they both continue to benefit from employee in-migration and an improvement in the employment trends for existing residents. The Gateway markets (particularly the Bay Area) continue to lag, but are showing signs of improvement. Rent growth will likely follow employment growth as the rent roll gets re-leased in these markets.

We believe that NYC will recover faster than the Bay Area, due in part to more positive employment trends in NYC, and the headwinds posed by remote work in the tech sector.

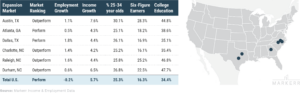

Trade Roundup: Sell the Coasts, Buy in the South and Southeast

Most trades last quarter were related to selling assets in New York and California and reallocating that capital toward Washington, D.C., the South and Southeast. EQR and AVB, in particular, announced expansion into the South and Southeast. EQR entered Austin, TX and Atlanta, GA, with plans to enter additional markets. AVB plans to enter Dallas, TX, Austin, TX, Charlotte, NC, and Raleigh-Durham, NC. These markets will likely continue to see outsized employment growth, income growth, and a large presence of high-earning individuals.

Identifying Affluent Renters Across the U.S.

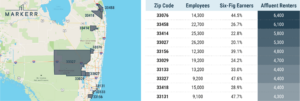

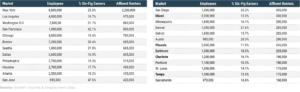

Markerr’s Income and Employment data set allows investors to analyze the number of six-figure earners in a market, which is a good proxy for affluent renters. The table below lists the total number of employees and the percentage of $100K+ earners. This information can be used to approximate the number of affluent renters in an MSA. Based on this data, we believe that Miami, Phoenix, Charlotte, and Tampa are likely expansion markets.

To further illustrate the power of this data set, we set out to identify attractive submarkets in the Miami MSA and looked at six-figure earners by zip code. We found that the highest concentration of affluent renters is along the Miami beachfront. The two other noteworthy areas are inland Miami and West Palm Beach.