Markerr looked at Southeast Florida and forecast rental rate growth over the next five years. Based on this analysis, the Miami-Fort Lauderdale-West Palm Beach MSA a is a middle-of-the-road investment, but we identified some zip codes with the potential to outperform. The most attractive submarkets are the Brickell section of Miami, the Harbordale neighborhood in Ft. Lauderdale and the downtown area of West Palm Beach.

Best Investments in SE Florida, by Zip Code

Below is Markerr’s proprietary rental rate forecast for the highlighted zip codes, projected to outperform the MSA average.

Our proprietary zip code level rent forecast was developed by backtesting our income and employment data to determine which of ~400 variables are most important for each zip code. Then, we incorporate additional datasets and our algorithm uses these metrics to create a rent growth forecast, identifying areas that are likely to outperform.

DOWNLOAD THE REPORT FOR THE COMPLETE RENT FORECAST

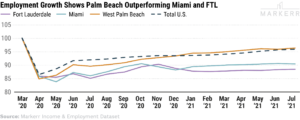

Employment is Lagging, But Income Shows Promise

Given the importance of the hospitality industry in Southeast Florida, employment significantly declined during the Covid pandemic. However, some income metrics such as median income, six-figure earners, and Millennial income have had a faster growth rate over the past five years compared to the rest of the country.

Hiring Activity Points to Growth in Median Income

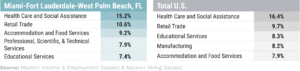

Southeast Florida has a higher percentage of workers in the accommodation and food services sector that was hit extremely hard by Covid, and also has a much higher concentration of professional, scientific, and technical service workers.

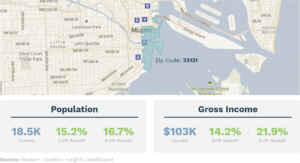

Best Bets: Brickell is an Attractive Area for Class A Investors

The Brickell submarket, (zip code 33131), is an affluent area of Miami with a high concentration of professional, scientific, technical and finance workers. It’s appealing because gross income in the area is over double the city average, the percentage of 25-34 year-olds is ~41% versus the market average of ~22%, population growth has outpaced the MSA average, and the homeownership rate is lower than city average. The downside is that there’s an excess of supply in Brickell, but the demand factors are too strong to ignore.