DOWNLOAD THE REPORT

Public REITs are among the largest commercial real estate owners across the U.S., with over 444,000 combined same-store units. They provide a real-time view into market-level performance, acquisition, and disposition trends.

Here are the takeaways from our analysis of REITs in the first quarter of 2022:

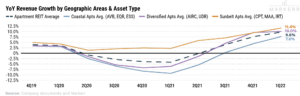

Takeaway #1: Rent Growth Accelerated Across the Board

The average revenue growth of the eight apartment REITs was 9.6% during 1Q22, marking the third straight quarter with positive year-over-year growth. Coastal apartment REITs continue to recover as the Omicron variant passed its peak and employers revisit return-to-office policies. Both Sunbelt and Diversified players posted near double-digit revenue growth in 1Q22.

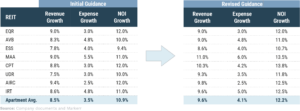

Takeaway #2: NOI Guidance Raised by 130 bps for FY22

The outlook for 2022 ticks upward as higher mortgage rates shifted housing demand from home ownership back toward rentership. Seven of the eight major apartment REITs raise their guidance, but expect a slower second half given the tougher comp.

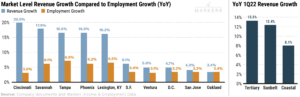

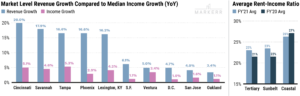

Takeaway #3: Tertiary Markets Show Strong Revenue and Employment Growth

Tertiary markets performed the best in a year-over-year comparison of revenue and employment, followed by the Sunbelt and Coastal markets. Tertiary and Sunbelt markets continue to see the best employment growth. Coastal markets continue to recover as return-to-office policies act as a catalyst for future housing demand.

Takeaway #4: The Affordability Gap Shrunk Between the Sunbelt and Coastal Markets

Affordability was a hot topic in earning calls. Markerr measured affordability based on rent-to-income ratio which shows that Sunbelt markets are still more affordable relative to Coastal markets (~23.5% vs ~26% rent-to-income ratios). However, the gap between the two continues to shrink as the Sunbelt markets see robust rent growth outpacing income growth.

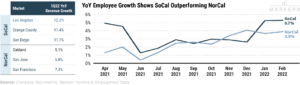

Takeaway #5: SoCal Vastly Outperformed NorCal

There is an extreme divergence in the operating trends of the California markets as recovery has eluded the Bay Area (San Francisco, San Jose, and Oakland) and Southern California markets, (Los Angeles, Orange County, and San Diego), are performing quite well.

After contributing to SoCal’s massive outperformance last quarter, Los Angeles (the 2nd largest REIT market) continues to boost SoCal’s outperformance relative to its Northern counterparts. SoCal experienced a large improvement in year-over-year employment growth, but still faces bad debt issues.