Markerr’s latest analysis of multi-family rent trends for 2022 showed that month-over-month rent has declined but there are indications that there will be positive rent growth over the next year.

Our report covers both the updated multi-family rent growth data through September 2022, and the one-year rent growth forecast. Notably, U.S. multi-family year-over-year rent growth was 5.1% in September 2022, down from 6.3% in August 2022. Forecasted rent growth over the next year will be up 7.3%, with the most gains in the Sunbelt region. Specifically, Sunbelt markets lead in rent growth (+7.0%), but dipped for the first time since July 2021, followed by Tertiary (+4.8%), Coastal (+4.7%), and Rustbelt (+4.3%) markets.

Here are more details about these trends:

Sunbelt markets dip below double-digit growth for the first time since July 2021

Eight of the 100 largest metros posted double-digit year-over-year rent growth in August, compared to 17 in July. The top 10 rent growth markets continue to be located in Florida and the Carolinas.

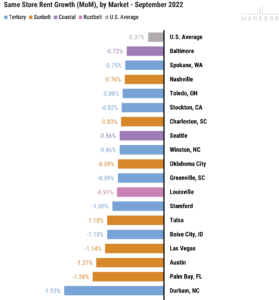

More markets experienced negative same store rent growth

The average national rent decreased by 0.3% in September, marking the first time in the last two years that the U.S. experienced sequentially negative rent growth. Eighty-two of the top 100 largest metros posted negative month-over-month rent growth, compared to 41 in August. High flying markets have experienced the sharpest declines.

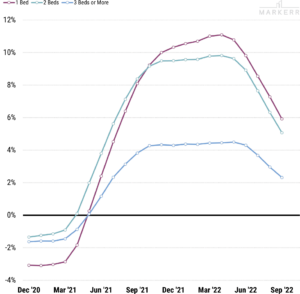

Rent growth for 1-bedroom units outpaced growth of 2 and 3-bedroom units

Rent for 1-bedroom units grew 5.9% year-over-year, led by Knoxville, TN (+15%), Bakersfield (+15%), Charleston (+12%), and Cape Coral (12%). Rent for 2- bedroom units grew 5.1% year-over-year, led by Charleston (+13%), Cape Coral (+12%), Greensboro (+11%), and Orlando (+11%). Rent for 3-bedroom units grew 2.3% year-over-year, led by Greensboro (+16%), Palm Bay (+14%), Deltona (+13%), and Toledo (+10%).