Markerr looked at key rent drivers like income, employment, and Gen Y tenure in coastal markets across the U.S., and found that Boston and San Diego present the best opportunities for multifamily investors. Both markets have experienced higher than average aggregate income increases, median income growth, job growth, and population growth relative to other coastal market peers.

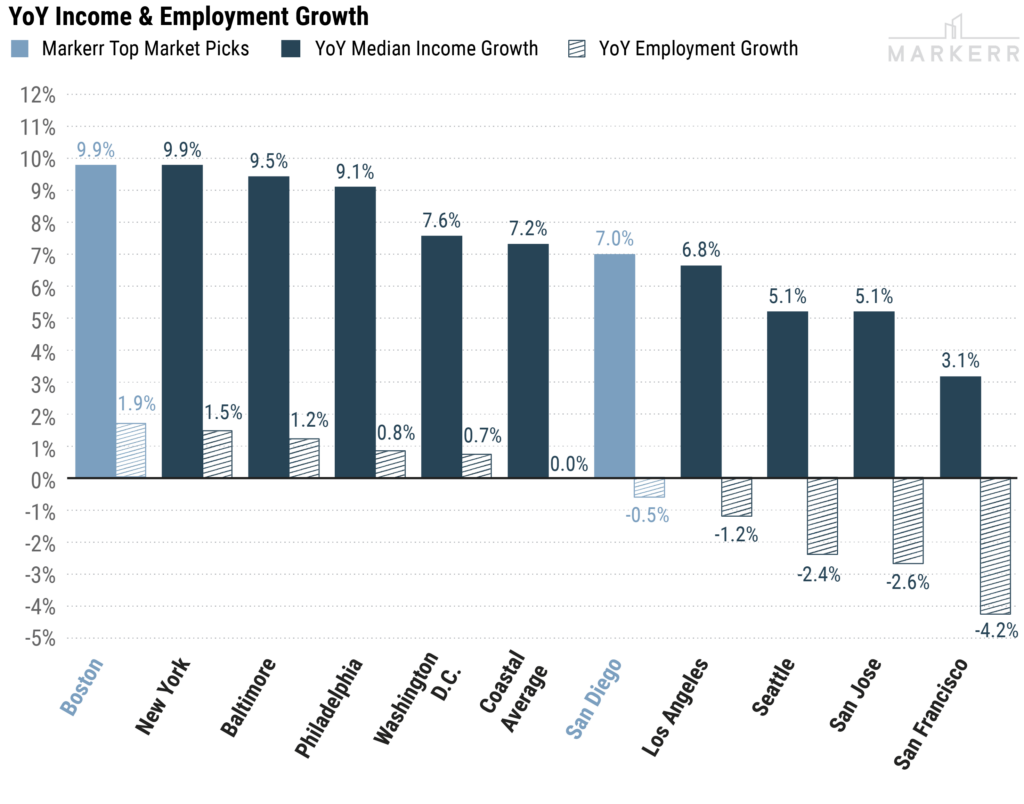

Employment and Income Growth Illustrate Why Boston and San Diego will Outperform

Job growth and median income have been solid over the past year for both Boston and San Diego. Boston leads the East Coast pack, while San Diego is the best performing West Coast market. Generally, we expect these trends to continue and to result in above-average rental rate growth.

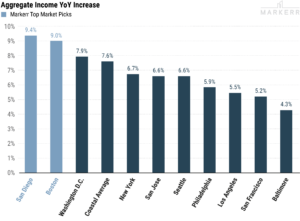

Boston and San Diego Also Boast the Highest Aggregate Income Increase

Boston and San Diego also led for growth in aggregate income, defined as median gross income * total employees. This is one of the main reasons Markerr believes that these MSAs will outperform over the next year.

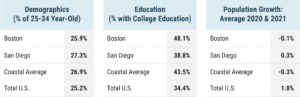

Boston and San Diego Have High Concentration of Attractive Renter Cohorts, Outperformance on Population Growth

Both markets have a high concentration of 25-34 year-olds and people with college degrees. They also show better than the average population growth for this asset type.