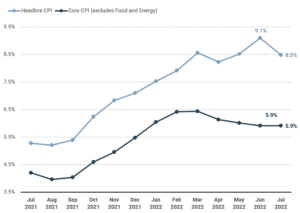

July 2022 CPI Finally Decelerates MoM

The Consumer Price Index for July came out at +8.5% YoY, which is a deceleration compared to last month’s 9.1%. The key drivers of the deceleration in inflation were the sequential declines in fuel (-11.0%), airlines fares (-9.6%), and gasoline (-7.7%).

Source: FRED, BLS

Wage Growth is Above Average, but Lags Sky-High Inflation, Leaving Consumers with Less Purchasing Power

While cost increases (inflation) are moderating, they still remain at peak levels relative to the longer-term history. Markerr’s Income & Employment data showed wage growth across the U.S. to be +5.2% YoY through May 2022. With CPI of +8.6% in May, this means that the effective real income number is down -3.4% YoY.

Headline CPI Will Likely Continue to Decelerate, but Core CPI May Remain Stubbornly High Due to Shelter Costs

Shelter makes up ~1/3 of the total CPI figure – and this will likely be slower to decelerate than the total headline CPI number. Markerr calculated shelter costs have increased ~30% YoY through May with higher homeownership costs, higher interest rates, and higher rent payments.

Residential Real Estate Will Likely Continue to Be Impacted by High Inflation and the Corresponding Increase in Interest Rates

Continuous high levels of Core CPI – driven by shelter costs – will likely lead to more rate hikes from the Fed. This leaves levered buyers facing higher financing costs and as a result, transaction volume has slowed in the last few months. Bid-ask spread suggests the market is in a price discovery phase with multi-family asset values down modestly and single-family prices showing no decline as of yet.