Markerr analyzed effective rent growth by market, occupancy trends and rent-to-income ratios for the top 100 markets in the first quarter of 2022 and found that rent growth across the U.S. remains well above historical norms.

Multifamily investors enjoyed double digit year-over-year rent growth in the first quarter of the year. Our analysis showed that the top 10 markets have rent growth above 20%, with four Florida markets dominating the list. In addition, despite being one of the worst performers last year, the New York metro area saw a huge ~25% improvement over last year.

Here are some additional findings from our national rent growth and affordability analysis:

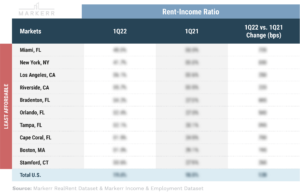

Rent Growth Outpaces Household Income Growth, Making More Markets Rent-Burdened

Out of the top 100 MSAs, ~90% saw an increase in the rent-to-income ratio over last year. Miami remains the least affordable metro area in the U.S., with New York as a close second. Interestingly, 11 markets are above the 30% affordability threshold, compared to last year which only had four markets.

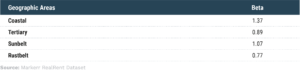

Coastal Markets Experience More Volatility

Markerr utilized market betas to assess risk premiums in the event of a demand side slowdown, calculating the market beta across the entire time period (2011 through 1Q 2022). We found that Coastal markets have experienced more volatile rent growth than the broader market, while Sunbelt peers saw a 1.07 beta across the entire time period with an increase from pre-Covid beta of 0.99.