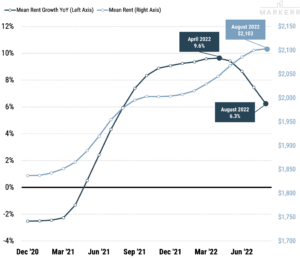

To gain a more complete understanding of national rent trends, Markerr updated our national rent index methodology from using an equal weighted average of rent prices across all MSAs to using property-level data for a unit weighted national average. Our analysis of the third quarter of 2022 revealed that national year-over-year rent growth was 6.3% in August, down from 7.5% in July. Also, the average U.S. monthly rent hit a new record of $2,100 in August 2022, up 0.1% over the previous month.

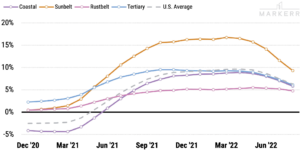

Sunbelt Markets Lead in Rent Growth, But Dip Below Double-Digit Growth For First Time Since July 2021

Florida and the Carolinas dominate the top 10 markets for rent growth. In addition, 48 of the 100 largest metros had year-over-year rent growth above the U.S. average, compared to 43 in July. However, deceleration continues with 17 of the 100 largest metros posting double-digit year-over-year rent growth in August, compared to 23 in July.

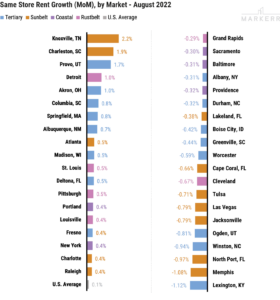

Month-over-Month Data Shows More Markets Experienced Negative Same Store Rent Growth

The 41 out of 100 largest metros posted negative month-over-month rent growth, compared to just 11 out of the top 100 in July. Among those 41 markets, 14 are located in the Sunbelt, 17 are in Tertiary markets, 5 are in the Rustbelt and 5 are in Coastal markets.

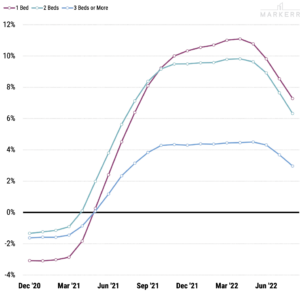

One- Bedroom Year-Over-Year Rent Growth Outpaces two- and three-Bedroom Units

Rent for one-bedroom units grew 7.3% year-over-year, led by Charleston, SC (+15%), Cape Coral (+15%), Miami(+15%), and Palm Bay (15%). Rent for two-bedroom units grew 6.3% year-over-year, led by Cape Coral (+18%), Charleston (+16%), Durham (+14%), and Greensboro, NC (+14%). Rent for three-bedroom units grew 3.0% year-over-year, led by Greensboro, NC (+17%), Palm Bay (+16%), Knoxville (+13%), and Deltona (+13%).